2016 Fiscal Follies and Reasons for Hope

Dec 26, 2016 - Committee for a Responsible Federal Budget

As 2016 comes to a close, itfs time to look back at the top fiscal developments of the year.

Being optimists here at the Committee for a Responsible Federal Budget, we had hoped to offer a list of stirring accomplishments that would get the nationfs fiscal house in order.

But it was not that type of year.

Instead, we must once again offer our Fiscal Follies: the 10 worst fiscal moments of 2016.

But lest we be accused of being too gloomy, we do offer a few rays of hope as well.

And, therefs always next yearc.

The Bottom 10 Fiscal Follies of 2016

10. No Budget; No Surprise

A budget is essential to effective government and to realizing our national priorities. However, lawmakers have not met the April 15 budget resolution deadline since 2003 and have passed only two complete budget resolutions in the past eight years. This year was no different: Congress failed once again to pass a budget.

9. Littering the Campaign Trail with Myths

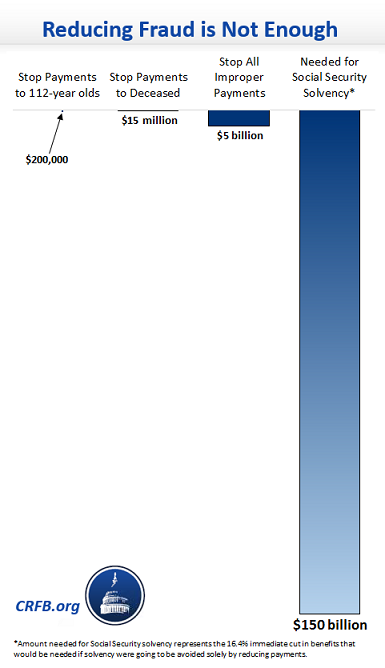

Negotiating Medicare drug prices would save $300 billion from a $100 billion program? You can fix the debt solely by taxing the top 1 percent? Reducing fraud would make Social Security solvent? These are just a few of the myths we heard on the campaign trail. Our Fiscal FactCheck project was busy separating fact from fiction throughout the campaign. Myths may get votes, but they make finding solutions even harder.

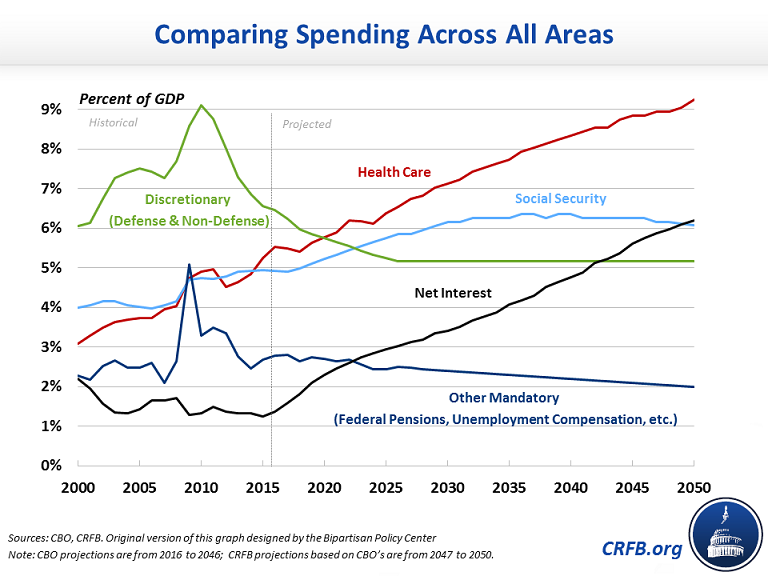

8. Health Care Costs Headed Off the Charts

There was hardly any discussion of getting health care costs under control, even as they're predicted to grow faster than the economy. Health care will be a key driver of growth in the national debt. Aside from interest on the debt, it will be the fastest growing part of the federal budget. We need legitimate prescriptions for containing health care costs, not snake oil from politicians.

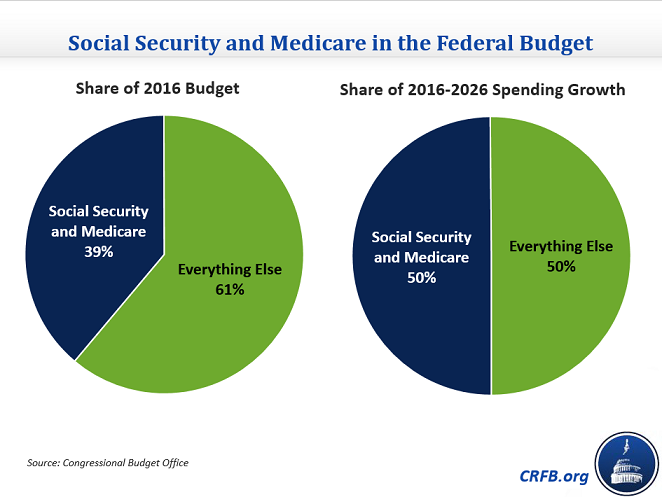

7. Taking Much of the Budget Off the Table

Instead of putting forward viable ideas to reduce the debt, candidates were much more eager to reduce the available options to achieve fiscal sustainability. Donald Trump and Hillary Clinton promised not to touch Social Security or Medicare, which make up 40 percent of the federal budget and will contribute to much of the long-term debt, accounting for 50 percent of spending growth over the next decade.

6. No Appropriate Time for Appropriations

The annual appropriations process has become so dysfunctional that congressional leaders made a point of promising that they would complete the process on time this year. Well, that didnft turn out so well. Only one of twelve government spending bills was passed before the September 30 deadline, with stopgap measures used to fund the rest of the government. Congress will need to finish its work next year.

Sources: House Appropriations Committee, Senate Appropriations Committee, CQ, Congress.gov

5. A Deficit of Solutions in the Campaign

We heard a lot about emails and beauty contestants in the campaign, but not much about the budget deficit or national debt. Presidential candidates largely acknowledged that the debt is a problem, but they offered few concrete solutions, despite polls showing that voters wanted to hear from candidates on this issue and repeated warnings from the Congressional Budget Office (CBO) and others that the situation is going to get worse.

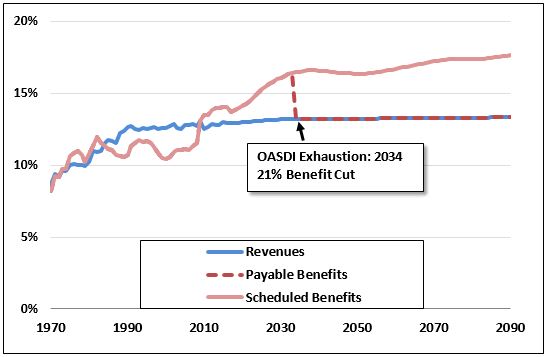

4. Setting the Trust Funds Up for a Fall

The Social Security, Medicare, and highway trust funds all face insolvency, but lawmakers seem to be in no hurry to fix them. CBO says the Highway Trust Fund will be insolvent in 2021. According to their Trustees, the Social Security Disability Insurance Trust Fund is expected to reach insolvency by 2023, the Medicare Hospital Insurance Trust Fund by 2028, and the Social Security Old Age and Survivorfs Trust Fund by 2035. The combined Social Security trust funds are due to be exhausted by 2034. That means an immediate 21 percent benefit cut for all recipients. The longer policymakers wait, the more difficult it will be to fix these trust funds.

3. Promises of Growth Became a Growth Industry

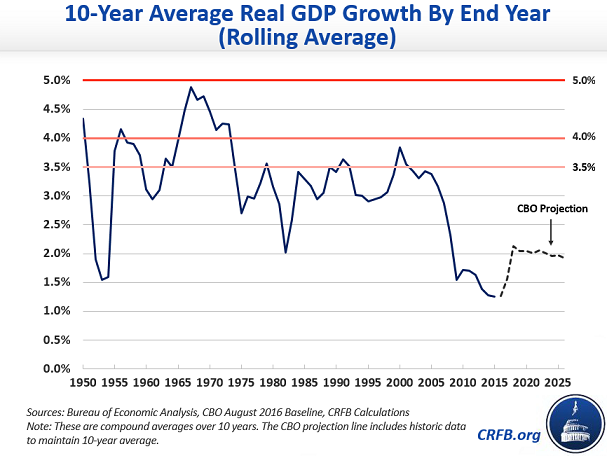

Economic growth is critical to fixing our fiscal problems, but growth alone will not be enough. You would not have known that from listening to the candidates. Growth was the go-to answer when candidates were pressed on how they would deal with the debt. It seemed like a bidding war: who could promise the most growth? But as we pointed out, history suggests that sustained growth of 4 percent is highly unlikely and probably unachievable given our aging population.

2. End of the Era of Declining Deficits

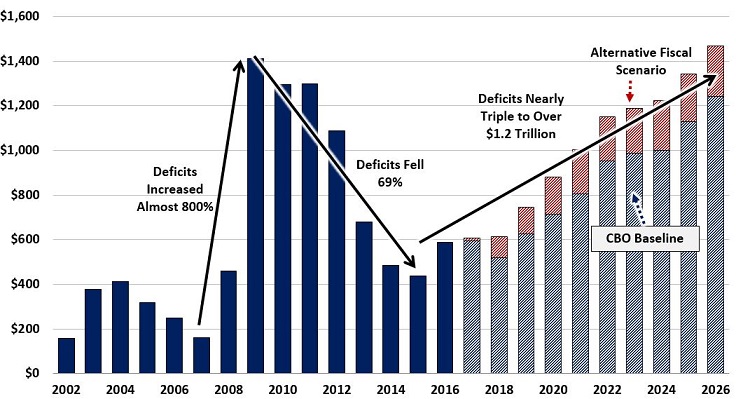

President Obama and other policymakers often pointed out that deficits had declined over the past four years, claiming that meant progress in addressing our fiscal challenges. Put aside that the focus should never have been on the short-term deficit but rather the medium- and long-term debt, even that deficit claim doesnft work anymore. The deficit increased by more than one-third in Fiscal Year 2016 to $587 billion. And deficits are set to remain on an upward path; theyfre expected to pass $1 trillion by 2024. We need long-term solutions, not short-term trends.

And the biggest fiscal folly of 2016 was:

1. Paving the Road to the White House with Red Ink

During the presidential campaign, neither candidate had a plan to slow the growth of our national debt. We estimated that Hillary Clintonfs proposals would allow the debt to grow by $9 trillion over the next decade, as projected under current law. But President-elect Donald Trumpfs proposals would add another $5.3 trillion of debt to what is already projected under current law. As a result, under his plan debt would grow from 77 percent of GDP today to 105 percent of GDP in ten years.

2016's Top Reasons for Hope

Fortunately, there were a few rays of hope. Here they are, in no particular order.

1. Trump Moderated His Plans

Even though his proposals still added considerably to the debt, Donald Trump did alter his campaign promises in the face of criticism. Following our first analysis of his proposals, he modified his plans to reduce the cost from $11.5 trillion to $5.3 trillion. Thatfs still way too much, but it was progress in the right direction.

2. Budging on Budget Reform

Ongoing budget process dysfunction spurred Congressional leaders to put forward serious budget process reform ideas, with possible action in 2017. House Budget Committee Chair Tom Price (R-GA) unveiled a comprehensive reform plan at a forum we co-hosted. Senate Budget Committee Chair Mike Enzi (R-WY) also outlined a reform plan. And Senator David Perdue (R-GA) presented budget reform ideas as well. Meanwhile, our Better Budget Process Initiative has developed lots of budget reform ideas.

3. Momentum for Tax Reform

Itfs been thirty years since the tax code was last revamped. However, momentum is building for tax reform. House Republicans put forward a comprehensive plan this year and it looks like there will be a serious push in 2017. In addition, Republican leaders are saying that tax reform needs to be deficit neutral. A more efficient and competitive tax system that raises at least as much revenue as the current system can help put us on a more sustainable fiscal path.

4. Candidates Were Asked About the Debt

Although their answers were not very helpful, the candidates did get serious questions about our fiscal situation during the debates, and we were mentioned several times. And our analysis of the candidatesf plans was cited countless times as the media attempted to flesh out their positions. This bodes well for increased scrutiny and fiscal accountability in 2017.

5. Ideas to Strengthen Social Security

Social Security is called the third rail of American politics, but the current is running low on power as its trust funds head towards insolvency. Representatives John Delaney (D-MD) and Tom Cole (R-OK) introduced legislation to form a bipartisan commission to come up with a solution. And Rep. Reid Ribble (R-WI) introduced bipartisan legislation to make Social Security solvent for 75 years. House Social Security Subcommittee Chair Sam Johnson (R-TX) also offered a reform bill. See how old you will be when the Social Security trust funds run out. And create your own plan with our gReformerh tool.